Are you exploring

decentralized finance?

Are you looking to optimize the calculations

of your liquidity pools on TradingView?

Are you looking to optimize the calculations

of your liquidity pools on TradingView?

We have developed indicators in collaboration with community members who have expertise in DeFi as well as Pinescript development. These indicators facilitate calculations for your liquidity pools.

Our indicators for TradingView (included in your subscription)

TradingView Indicator

CryptoLogik LP

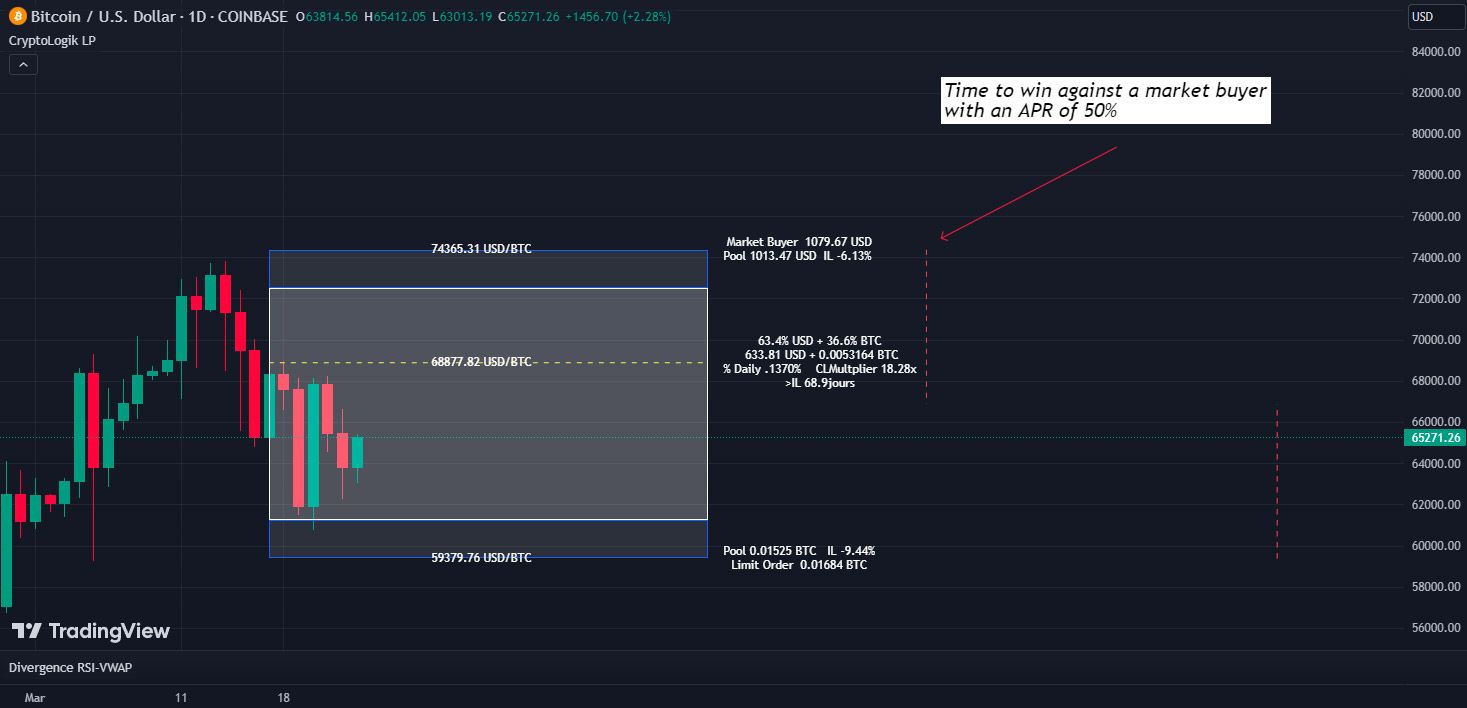

Introducing the premier instrument in our trio of liquidity tools. This innovative indicator furnishes comprehensive insights into liquidity pools, urging you to pinpoint three critical data points: the bottom, top, and entry price ranges. Utilizing these parameters, it meticulously calculates essential metrics you require, including:

- Impermanent loss on the upper side, comparing pool value against direct market purchasing.

- Impermanent loss on the lower side, contrasting pool value with that of a limit order.

- The pool's value and its composition at the upper limit.

- The pool's value and its composition at the lower limit.

- The pool's composition at the entry point, detailed in both percentages and actual token quantities.

- The Concentrated Liquidity Multiplier for the pool, illustrating its efficiency relative to a standard Uni V2 pool.

By adjusting parameters, you can tailor the initial amount and predict the Annual Percentage Rate (APR) of the pool. The tool then determines the requisite duration within the specified range to offset impermanent losses, indicated by red vertical dotted lines.

Advanced Feature:

For seasoned users, the "recovery pool" option transforms the indicator, showcasing a liquidity pool designed to compute the required pool value at a certain asset price. This is based on the width of the range at a specific entry price and amount, facilitating the calculation of optimal ranges to recuperate locked-in impermanent loss from previous strategies.

TradingView Indicator

CryptoLogik LP GM

This tool is expertly designed to incorporate essential calculations for a strategy based on the Geometric Mean, conceived through the work of Billy(vanbc) and Float_Locker. It meticulously calculates the corresponding level opposite to either the top or bottom range, anchored on the geometric mean. Users can access detailed insights on impermanent loss, the value of the pool at the asset's current price, the multiplier effect of concentrated liquidity, and the Geometric Mean itself.

TradingView Indicator

CryptoLogik LP Measure

This tool is meticulously crafted to present crucial insights for liquidity providers, featuring the lower range, upper range, and opening price.

Utilizing these parameters, it computes the Impermanent Loss and the Geometric Mean of the pool. Additionally, it monitors the pool's value in relation to the asset's current price. A notable feature is the "selectable level," a dynamic element that allows you to explore the pool's composition and value at specific price points.

This tool is perfect for strategic planning or a swift review of key data prior to initiating a liquidity pool.

Subscribe to

Logik DeFi Indicators today!

for TradingView

14,99 $/month

Monthly Subscription

Monthly payment with no commitment

DeFi Indicators

CryptoLogik LP

CryptoLogik LP GM

CryptoLogik LP Measure

For payments in crypto,

contact us on Discord

99,99 $/year

Yearly Subscription

One-time payment for the entire year

(rolling 12 months)

30 days

100% Satisfied or Money Back

DeFi Indicators

CryptoLogik LP

CryptoLogik LP GM

CryptoLogik LP Measure

For payments in crypto,

contact us on Discord